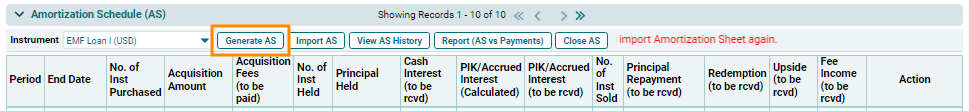

To generate AS, follow the below steps:

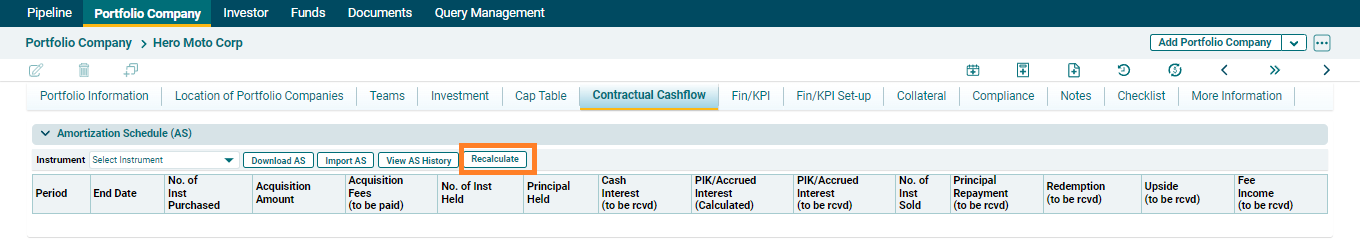

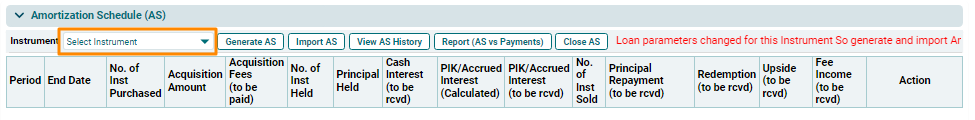

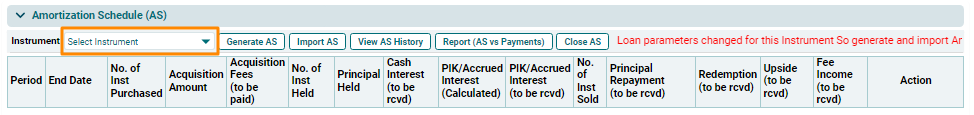

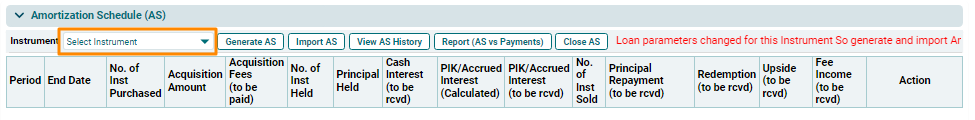

1. Click on the Select Instrument dropdown list, and select a Loan instrument.

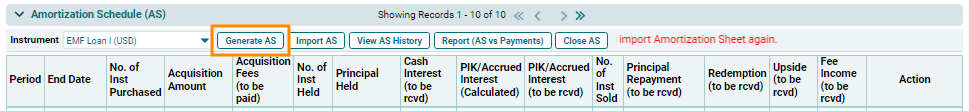

2. Click on Generate AS button on top of the panel

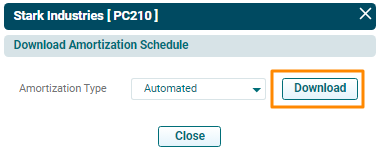

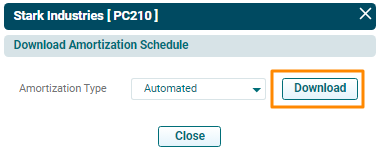

3. A new window is displayed. Choose an option from the dropdown list- Automated or Manual. Click Download.

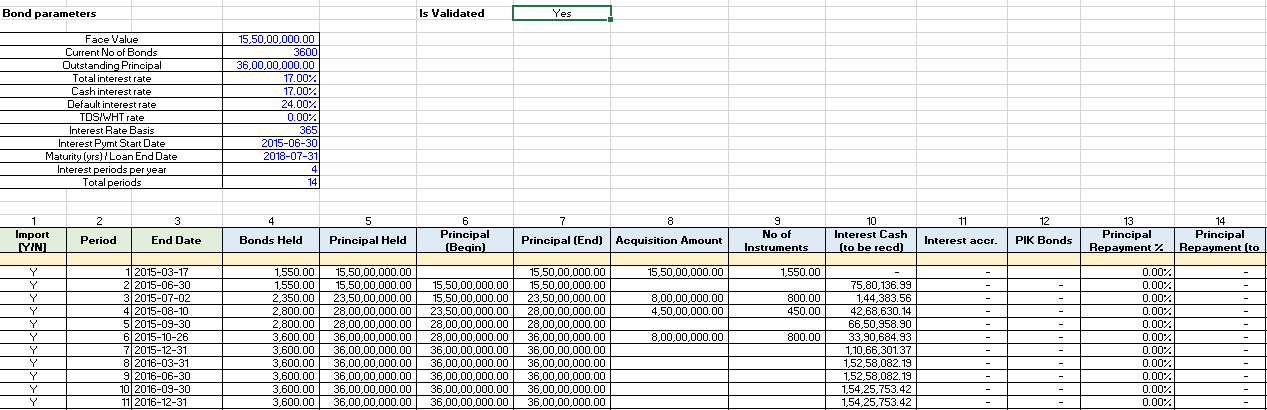

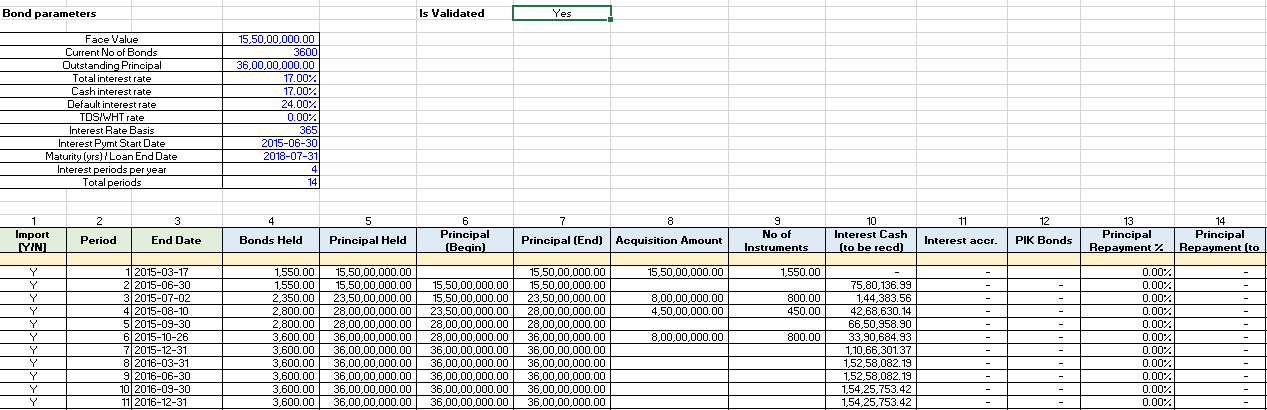

4. The excel file will download. This excel file contains a format of Amortization Schedule, where you can create am expected payment schedule for the underlying loan.

5. To validate the AS, change the AS Validated? field to Yes.

6. Save the file.

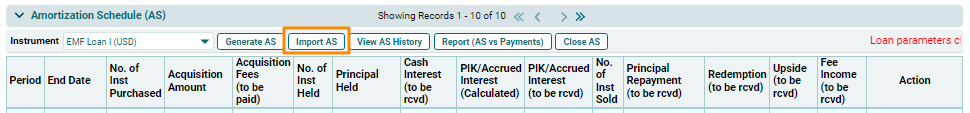

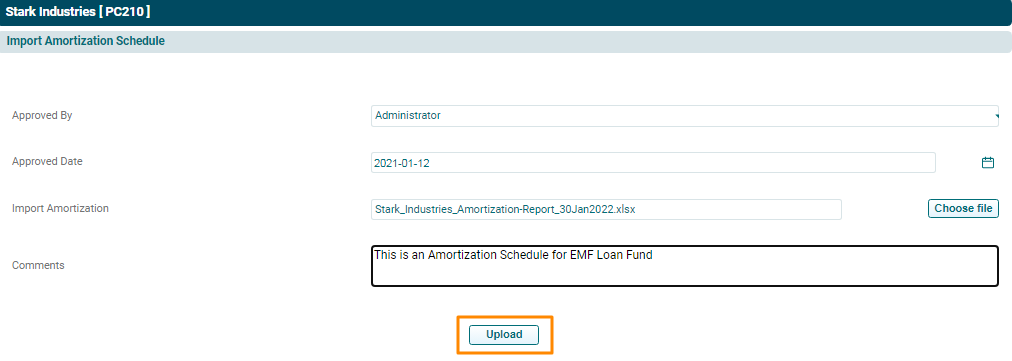

Import AS

To upload an Amortization Schedule, follow the below steps:

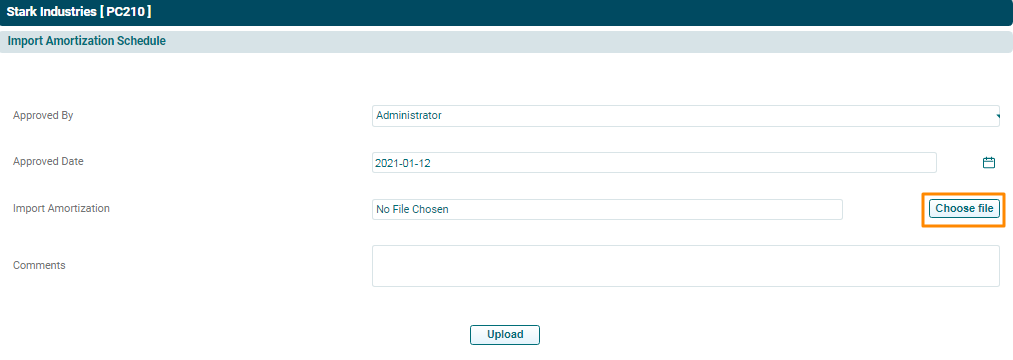

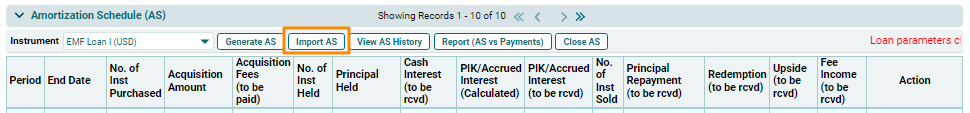

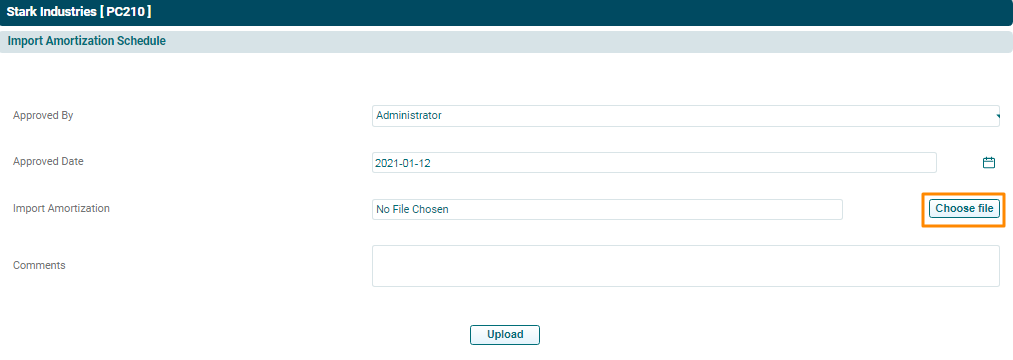

1. Click on Import AS button on top of the panel. 2. The Import Amortization Schedule window is displayed. Specify the name of approving authority and the date on which the approval was provided.

2. The Import Amortization Schedule window is displayed. Specify the name of approving authority and the date on which the approval was provided.

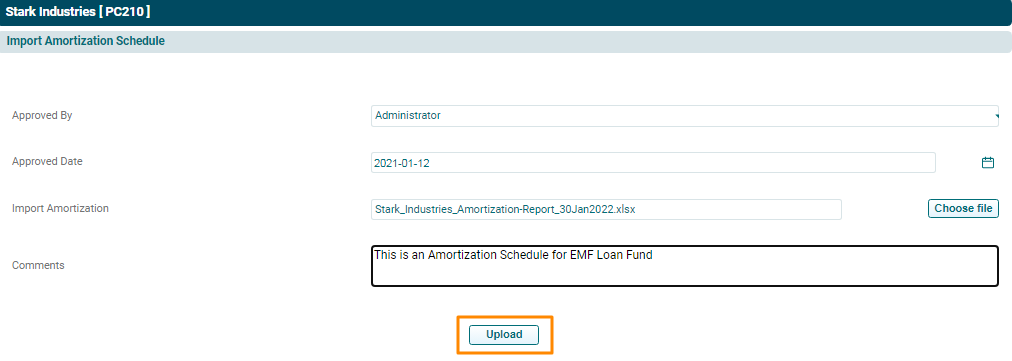

3. Click Choose File button. Choose the excel file containing the AS.

4. Specify Notes, if any.

5. Click Upload.

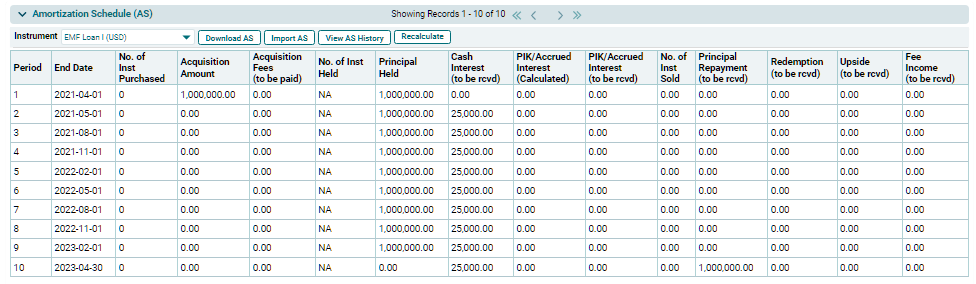

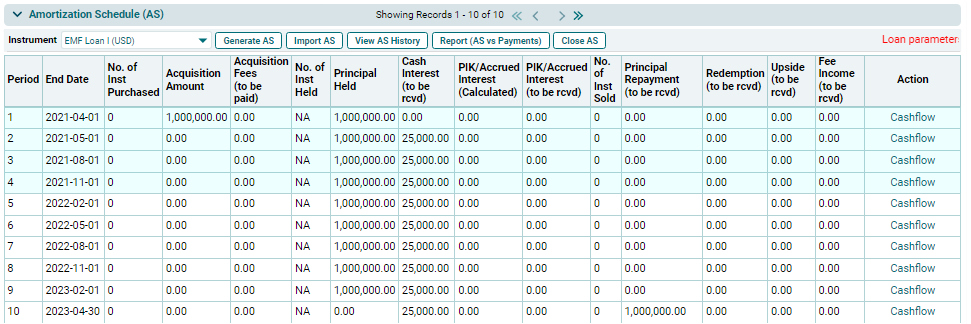

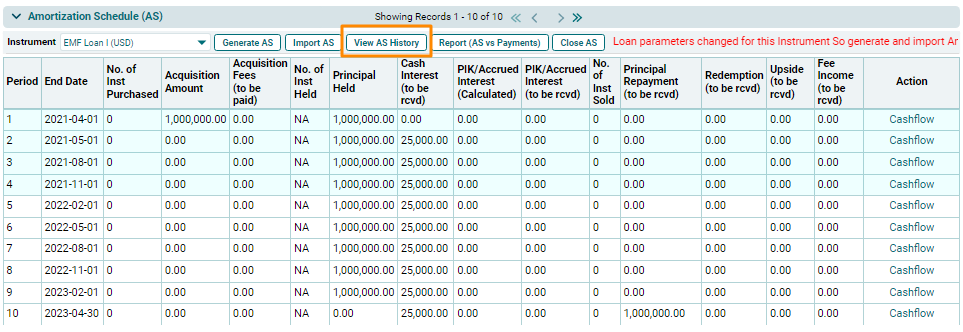

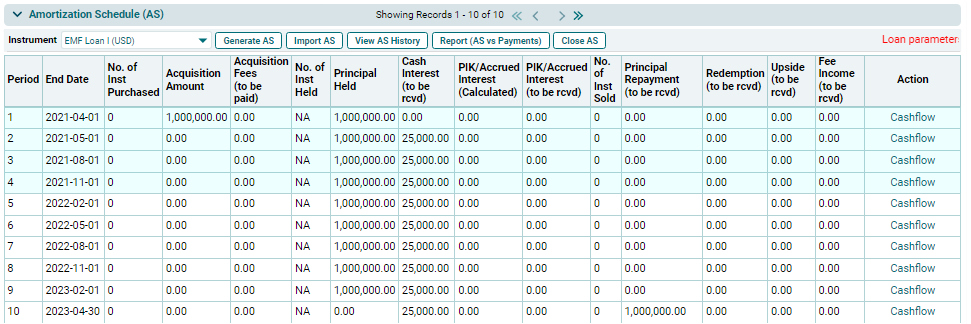

6. The Amortization Schedule shall be populated based on the file uploaded.

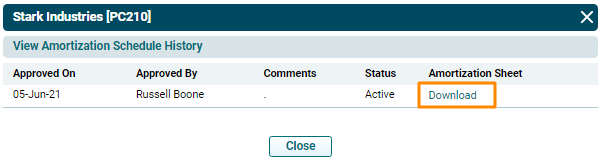

View AS History

This button allows you to see the AS history and the changes made. To view AS history, follow the below steps: