Deal Pipeline

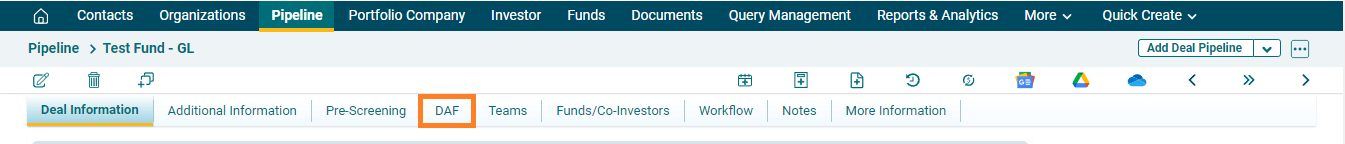

DAF

Once the preliminary screening form is accepted by SRI, the deal stage is moved to DAF which stands for Detailed Application Form and a new tab DAF is visible to AIF under Pipeline module. It is mandatory for an AIF user fill complete details in all the panels under DAF to proceed further in the application process.

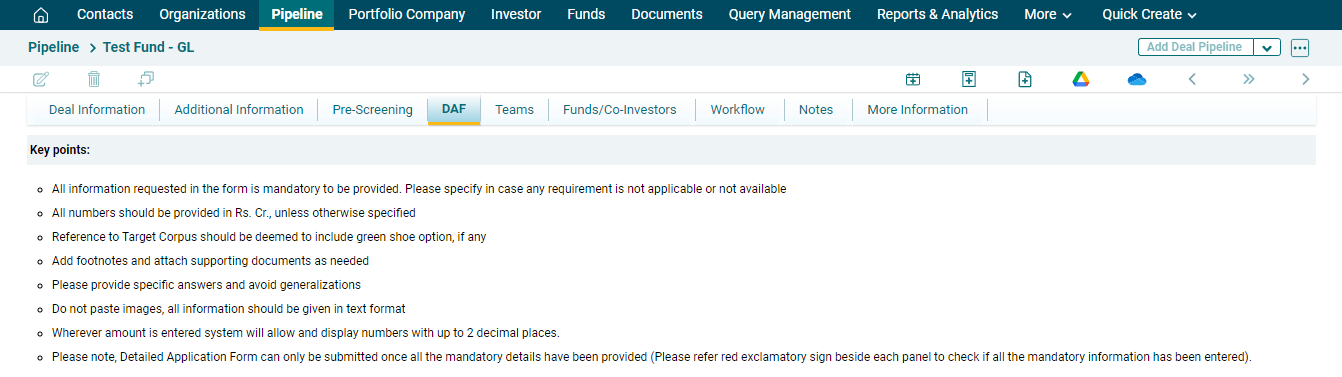

On clicking DAF, AIF will be able to see the guidelines for filling up the DAF on the top.

It consists of the following

panels.

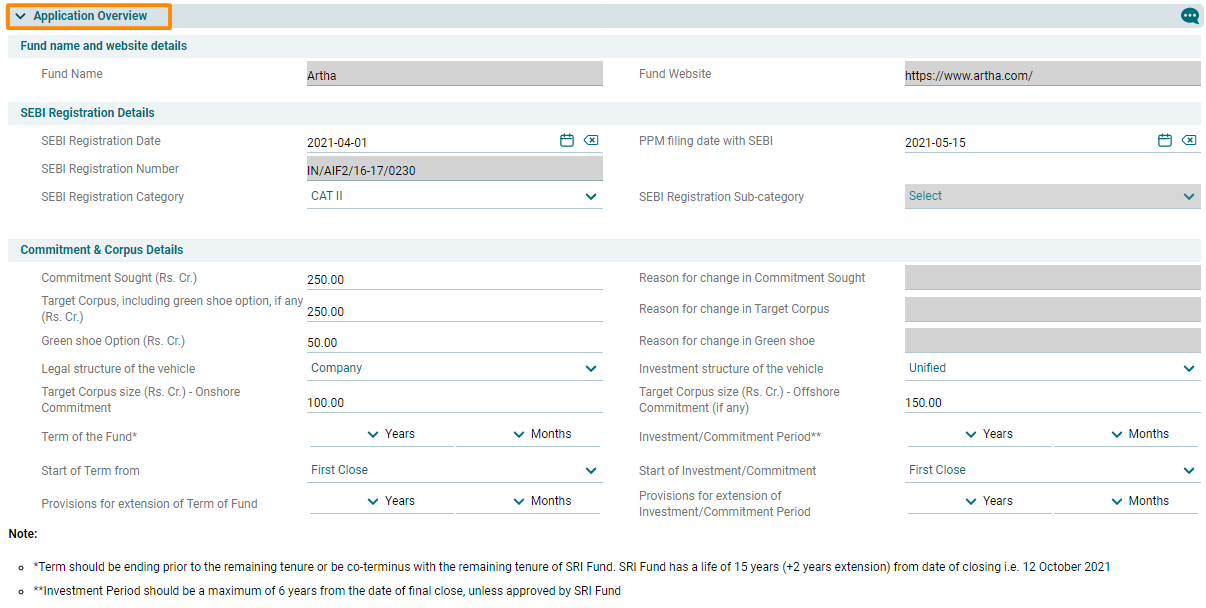

1. Application Overview

This panel offers a brief overview of the Deal.

It has the following sub-panels:

i. Fund Name and Website Details

In this sub-panel AIF user needs to fill the fund name and the website.

ii. SEBI Registration Details

In this sub-panel AIF user needs to fill the details of the fund, including registration date, number, category, sub-category, and PPM filing date.

Consider the notes following the sub-panel for correct data submission.

iii. Commitment & Corpus details

In this sub-panel AIF user needs to fill the details regarding total commitment, corpus fund, term of the fund, reasons for changes in amount, etc.

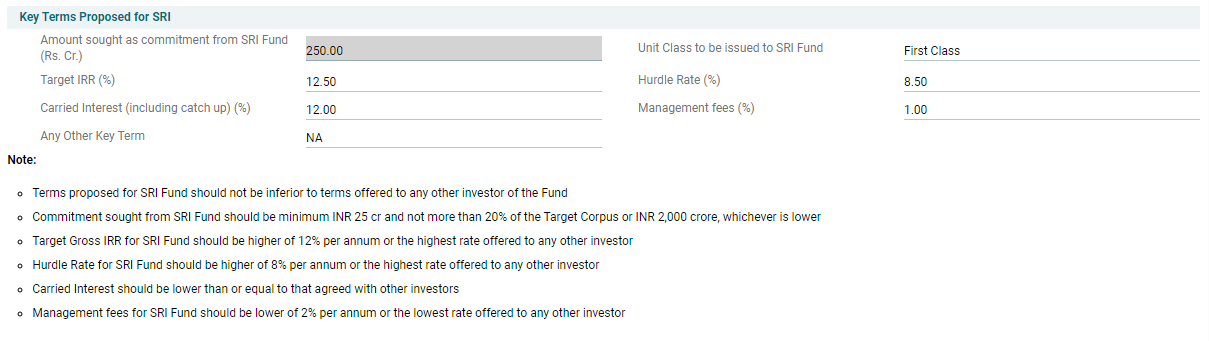

iv. Key Terms Proposed for SRI

In this sub-panel AIF users need to enter Self Reliant India (SRI) funding details.

The details included are:

- Amount sought as commitment from SRI Fund: In this AIF user needs to fill the total amount sought from the fund.

- Unit Class to be issued to SRI Fund: In this AIF user needs to fill the SRI Fund class.

- Target IRR (%): In this AIF user needs to fill the Target IRR.

- Hurdle Rate (%): In this AIF user needs to fill the hurdle rate.

- Carried Interest: In this AIF user needs to fill the total carried interest including catch-up.

- Management Fees (%): In this AIF user needs to fill the management fees as the percentage of total amount.

- Any Other Key Term: If there is any. Else, mark it NA.

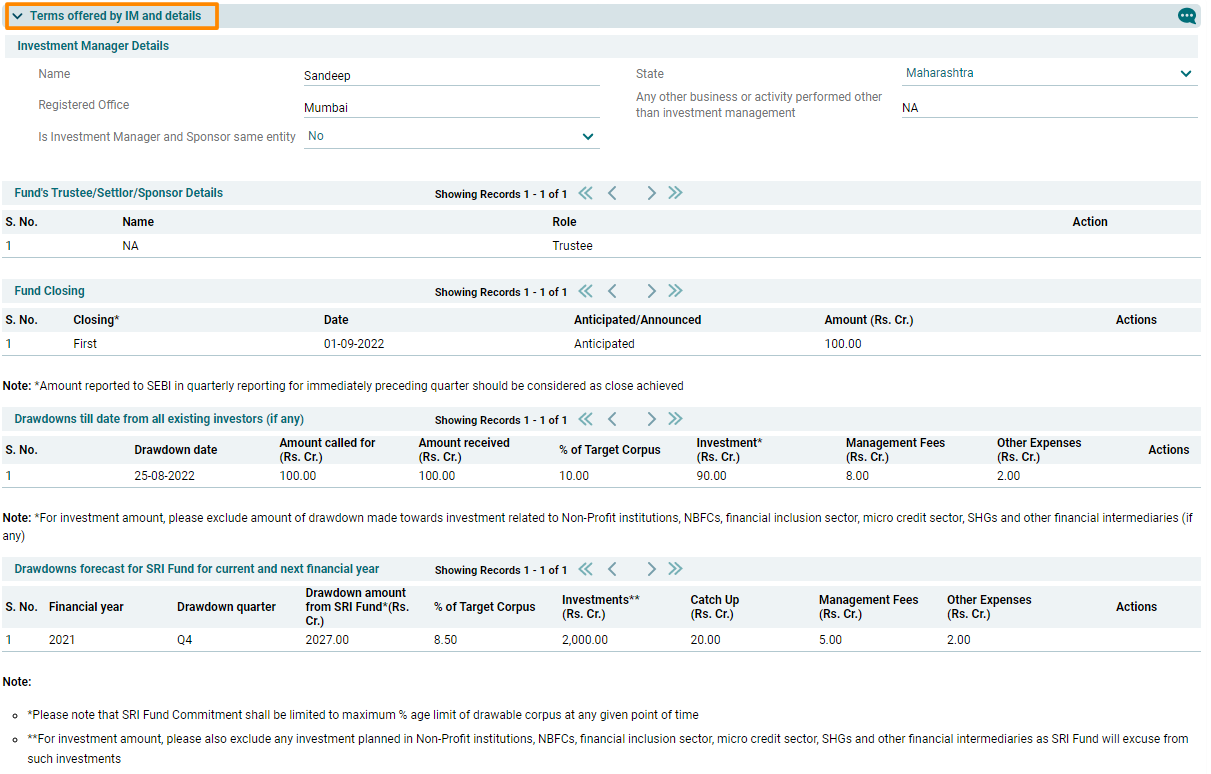

2. Terms Offered by IM and Details

In this panel AIF user needs to enter the data concerning IM and the contributions.

It has the following sub-panels:

i. Investment Manager Details

In this sub-panel AIF user needs to enter Investment Manager details including Name, state, registered office, etc.

ii. Fund’s Trustee/ Settlor/ Sponsor details

In this sub-panel AIF user needs to enter details of the fund’s trustee/ settler/ sponsor.

iii. Fund Closing

In this sub-panel AIF user needs to enter the details of the closed funds.

iv. Drawdown till date from all existing investors (if any)

In this sub-panel AIF user needs to enter the total drawdown received from any existing investors.

v. Drawdowns Forecast for SRI fund for current and next financial year

In this sub-panel AIF user needs to enter the forecasted data of drawdowns from SRI fund in the coming years.

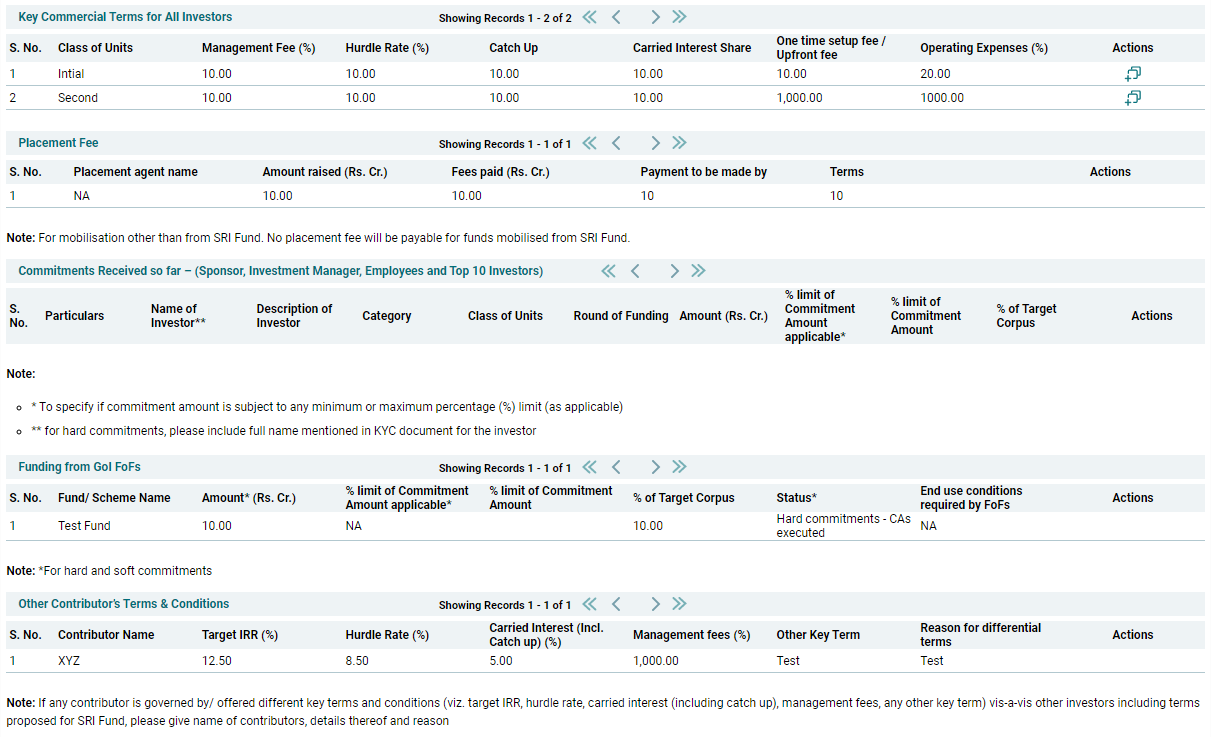

vi. Key Commercial Terms For All Investors

In this sub-panel AIF user needs to enter the commercial terms of the fund for all investors.

vii. Placement Fee

In this sub-panel AIF user needs to enter the placement fee paid for raising amount.

viii. Commitments received so Far

In this sub-panel AIF user needs to enter the total amount received out of the committed amount.

ix. Funding from Goi FoFs

In this sub-panel AIF user needs to enter the total funding received from Government of India Fund of Funds.

x. Other Contributor’s Terms and Conditions

In this sub-panel AIF user needs to enter the data of any contributor who is offering different terms and conditions, such as target IRR, hurdle ate, carried interest rate including catch up, management fees, any other key term, etc.

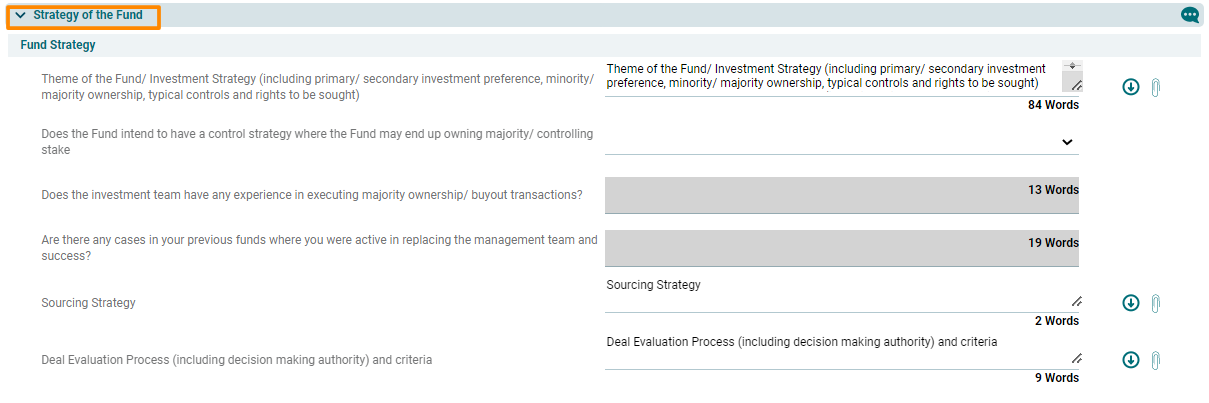

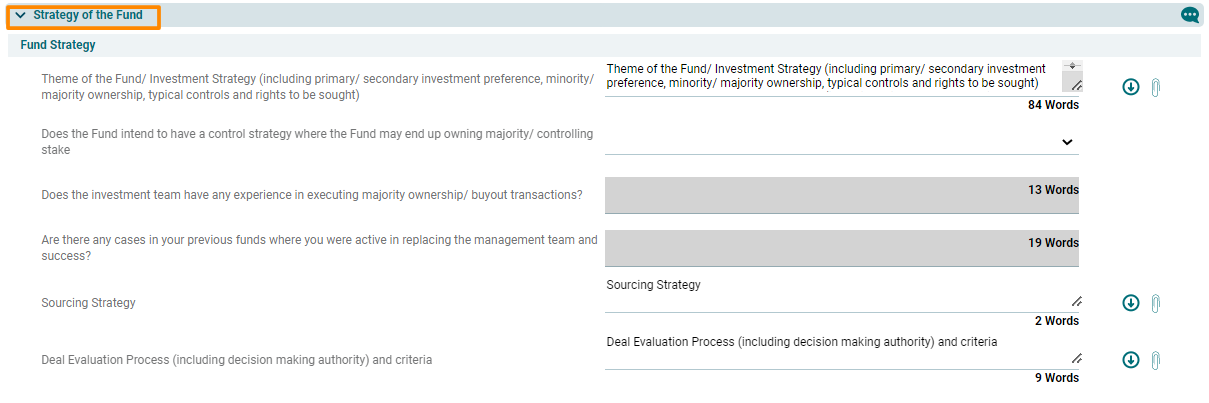

3. Strategy of the Fund

In this panel AIF user needs to enter the fund strategy, including details of

target locations, target sectors, deal strategy, investment strategy, etc.

It has the following sub-panels:

i. Fund Strategy

In this sub-panel AIF user needs to enter the theme of the fund, its control strategy,

team’s expertise in handling such projects, sourcing strategy, evaluation

process and criteria, etc.

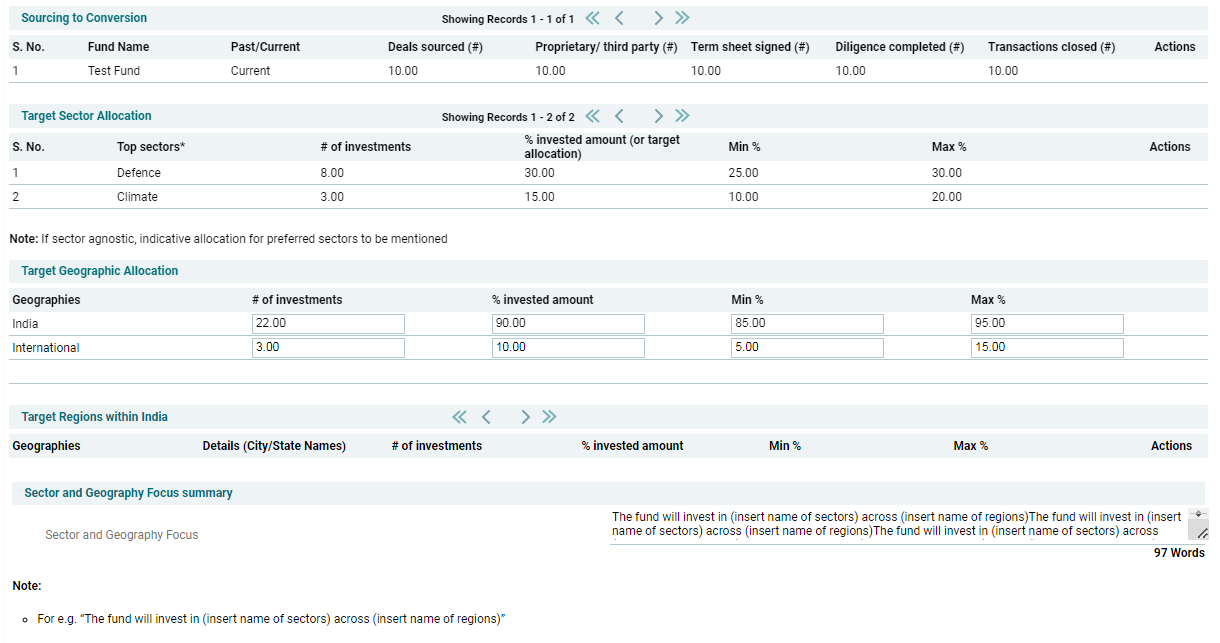

ii. Sourcing To Conversion

In this sub-panel AIF user needs to enter the deals converted and closed.

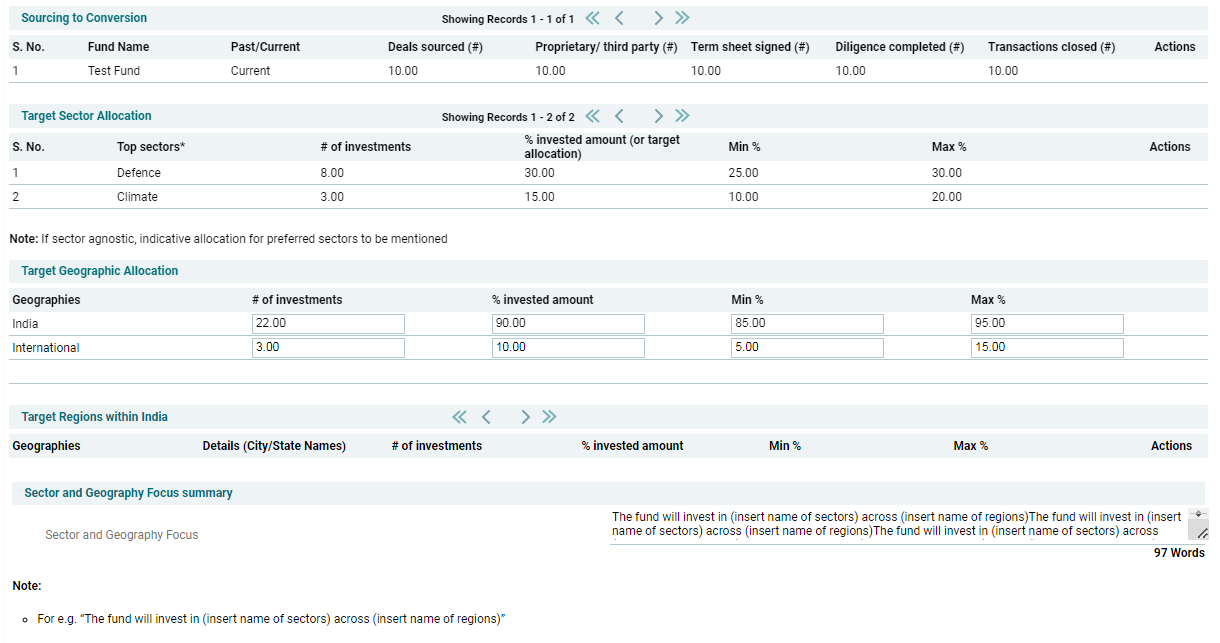

iii. Target Sector Allocation

In this sub-panel AIF user needs to enter the top sectors where fund amount

will be allocated.

iv. Target Geographic Location

In this sub-panel AIF user needs to enter the funds allocated within and

outside India.

v. Target regions Within India

In this sub-panel AIF user needs to enter the target regions within India.

vi. Sector and Geography Focus

Summary

In this sub-panel AIF user needs to mention a brief summary of

fund’s sector and geographical allocation.

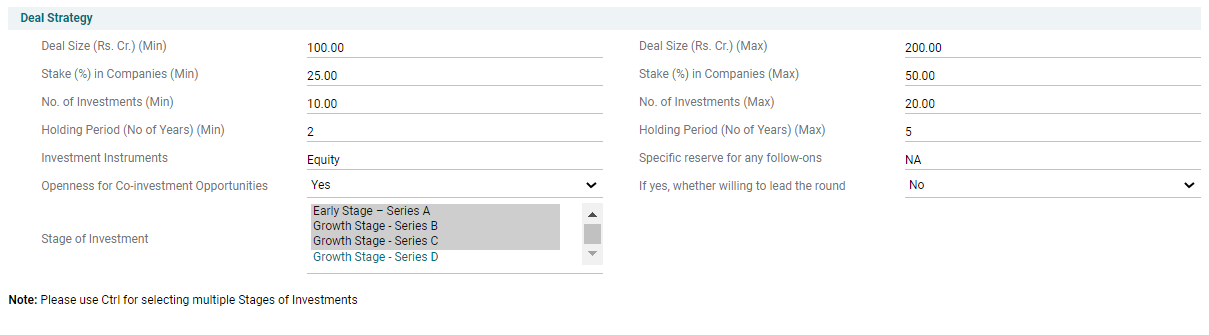

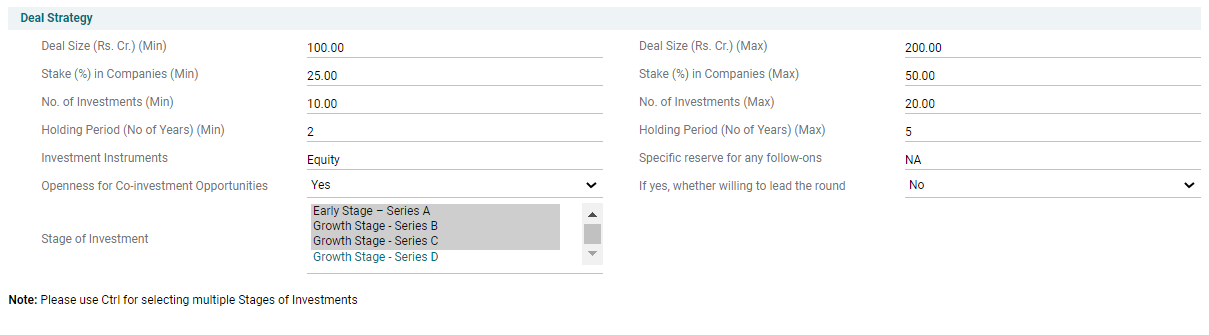

vii. Deal Strategy

In this sub-panel AIF user needs to enter strategy for the deal. The details

included are:

- Deal Size (in

Cr.)(Min.): In this AIF user needs to fill the minimum deal size.

- Deal Size (in Cr.)(Max.): In this AIF user needs to fill the maximum deal size.

- Stake (%) in

companies(Min.): In this AIF user needs to fill the minimum stake percentage in companies.

- Stake (%) in

companies(Max.): In this AIF user needs to fill the maximum stake percentage in companies.

- No. of Investments

(Min): In this AIF user needs to fill the minimum number of investment required.

- No. of Investments

(Max): In this AIF user needs to fill the maximum number of investment required.

- Holding period (in

Years) (Min): In this AIF user needs to fill the minimum holding period in years.

- Holding period (in

Years) (Max): In this AIF user needs to fill the maximum holding period in years.

- Investment

Instruments: In this AIF user needs to fill the instrument for investment.

- Specific Reserves for

any follow-ons: In this AIF user needs to fill whether there are any specific reserves.

- Openness for

Co-investment opportunities: In this AIF user needs to fill whether the fund is open to any

co-investment opportunities.

- If yes, whether

willing to lead the round: If the answer to the previous question is yes,

whether the fund would like to lead the round.

- Stage of Investment: In this AIF user needs to fill the stage of investment where the fund currently is.

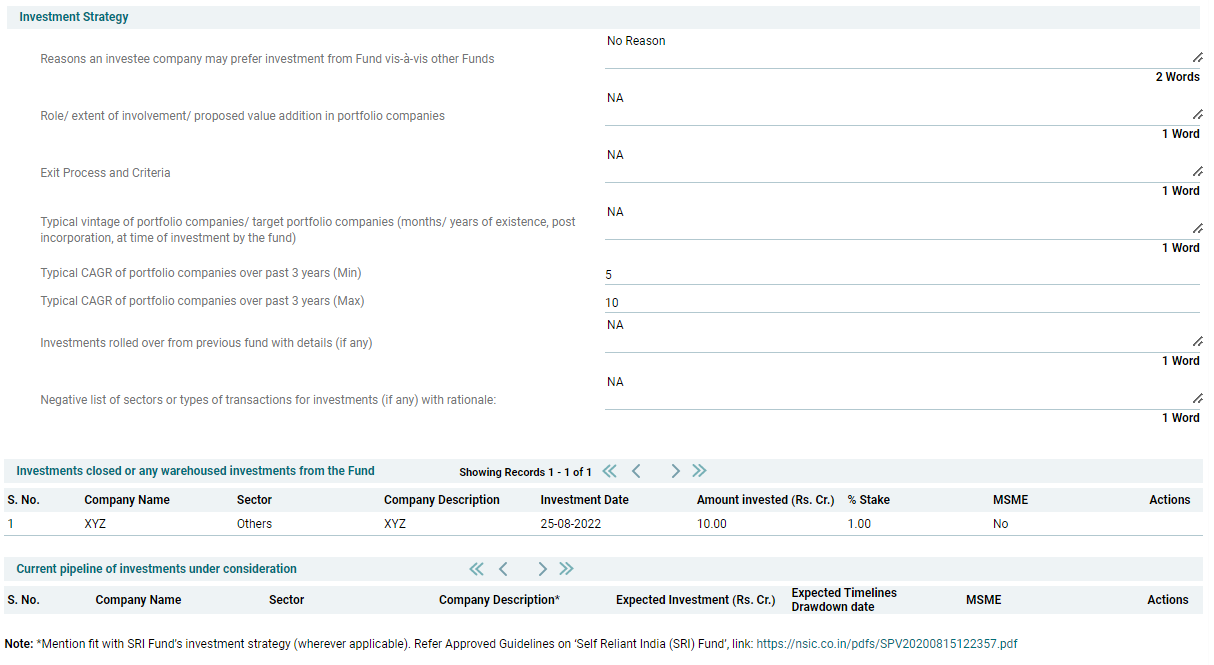

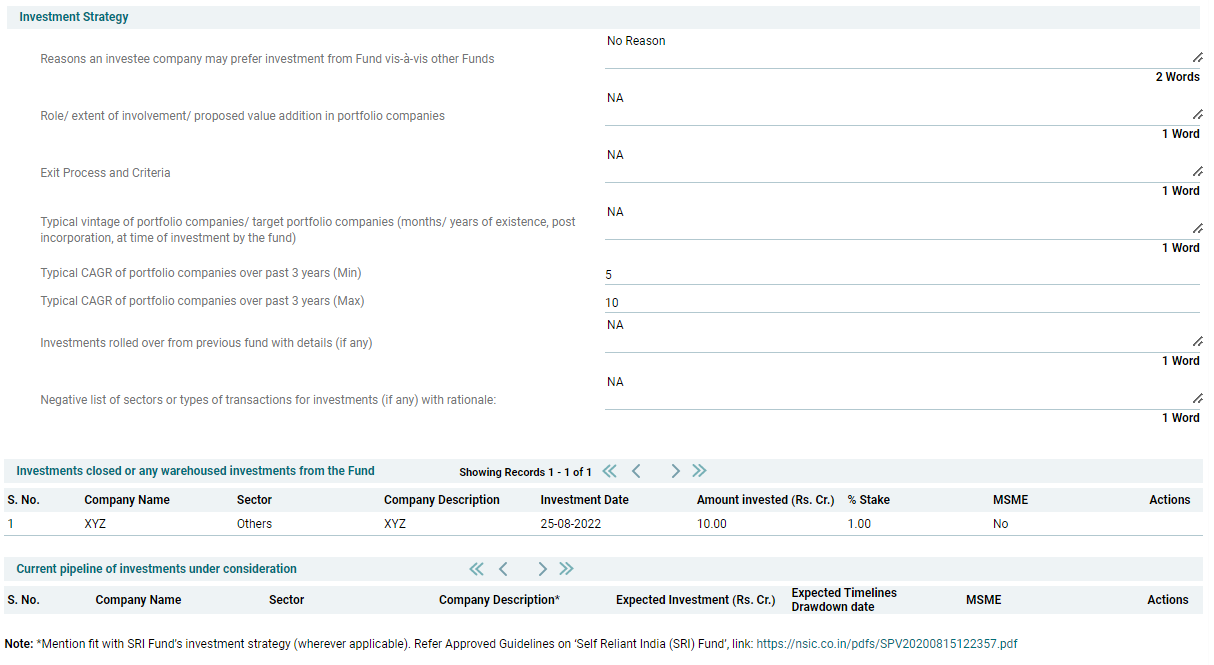

viii. Investment Strategy

In this sub-panel AIF user needs to enter the overall investment strategy.

ix. Investments Closed or any

warehoused funds from the investment

In this sub-panel AIF user needs to enter whether there are any closed or

warehoused funds from the investment.

x. Current Pipeline of

Investments under Consideration

In this sub-panel AIF user needs to enterthe current stages of investment

which are under consideration.

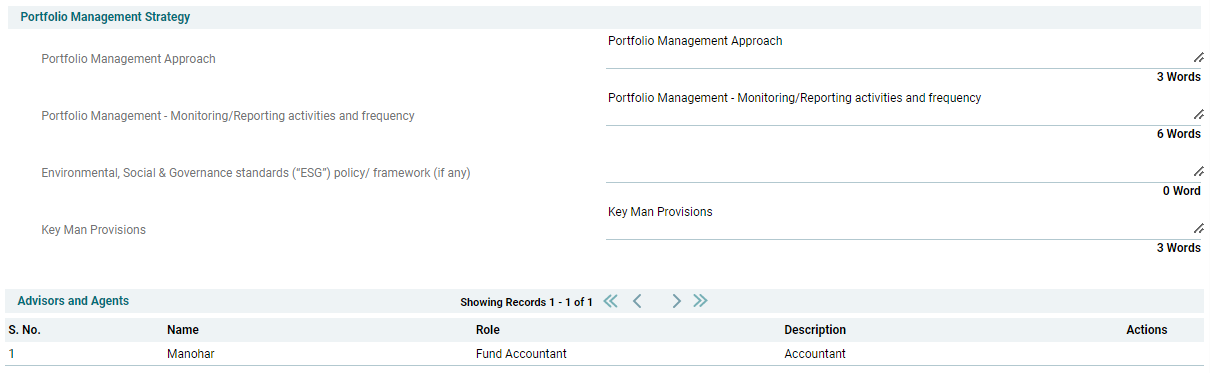

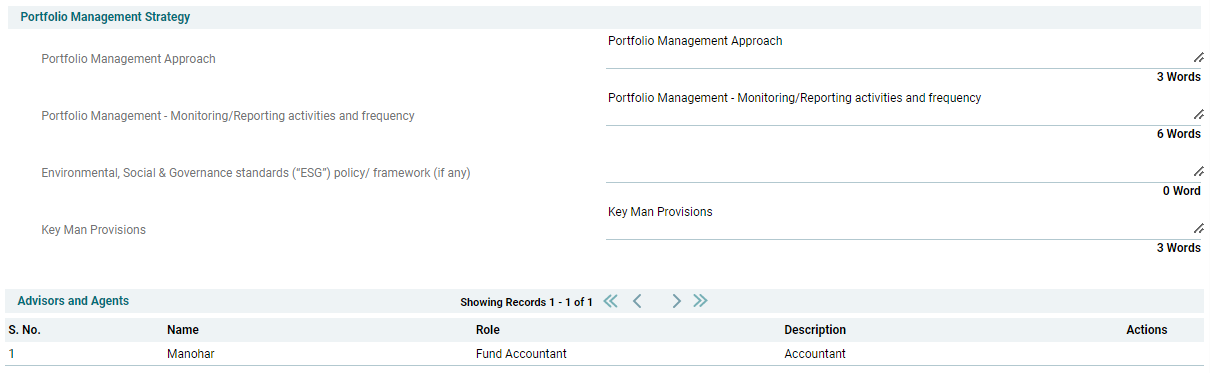

xi. Portfolio Management

Strategy

In this sub-panel AIF user needs to mention the approach for portfolio

management, its monitoring, ECG policies, etc.

xii. Advisors and Agents

In this sub-panel AIF user needs to enter the details of fund advisors and

agents.

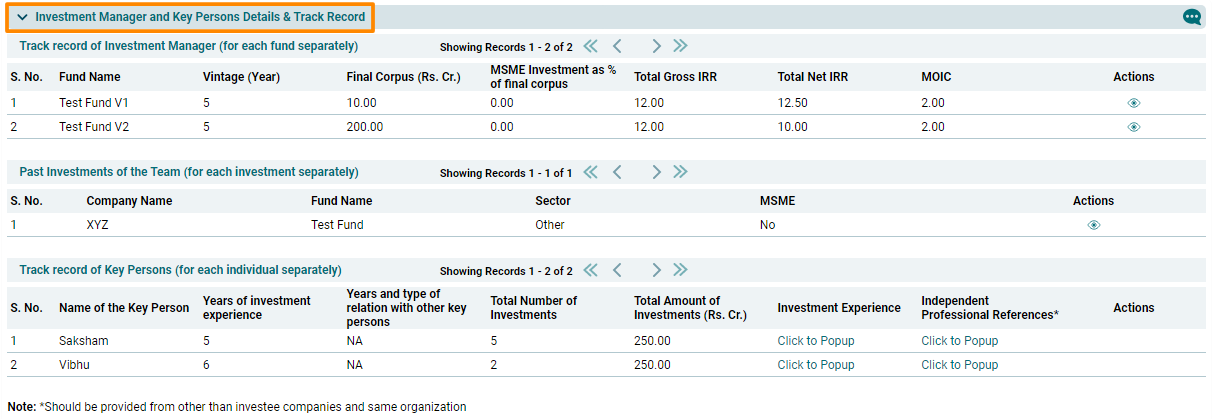

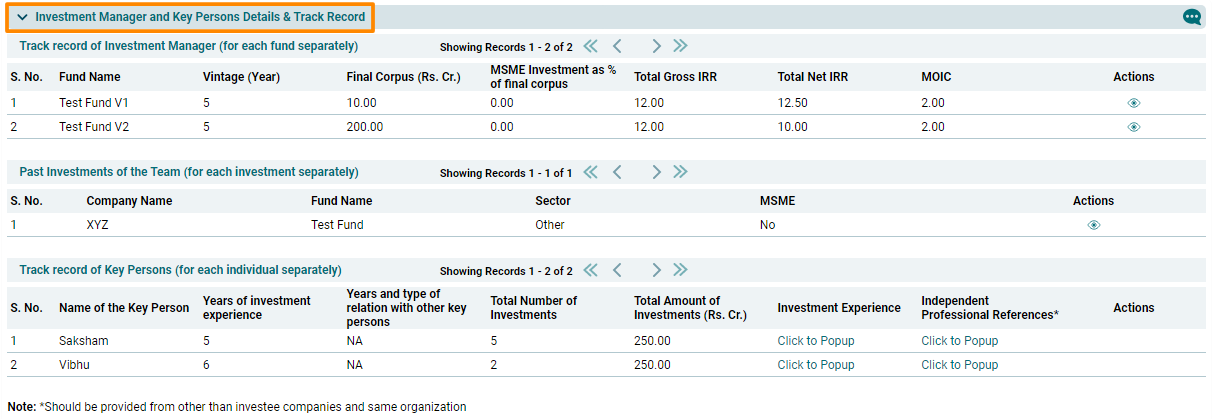

4. Investment Manager and Key Persons Details & Track Record

In this sub-panel AIF user needs to enter comprehensive data of Investment manager

and other key persons.

It has the following

sub-panels:

i. Track record Of Investment

Manager

In this sub-panel AIF user needs to enter the track record of Investment

Manager of working on past funds. Each fund is separately recorded.

ii. Past Investment of The Team

In this sub-panel AIF user needs to enter the past investment record of the

team for each investment separately.

iii. Track record of Key persons

In this sub-panel AIF user needs to enter the track record of fund’s key

persons, including their past investments and years of expertise.

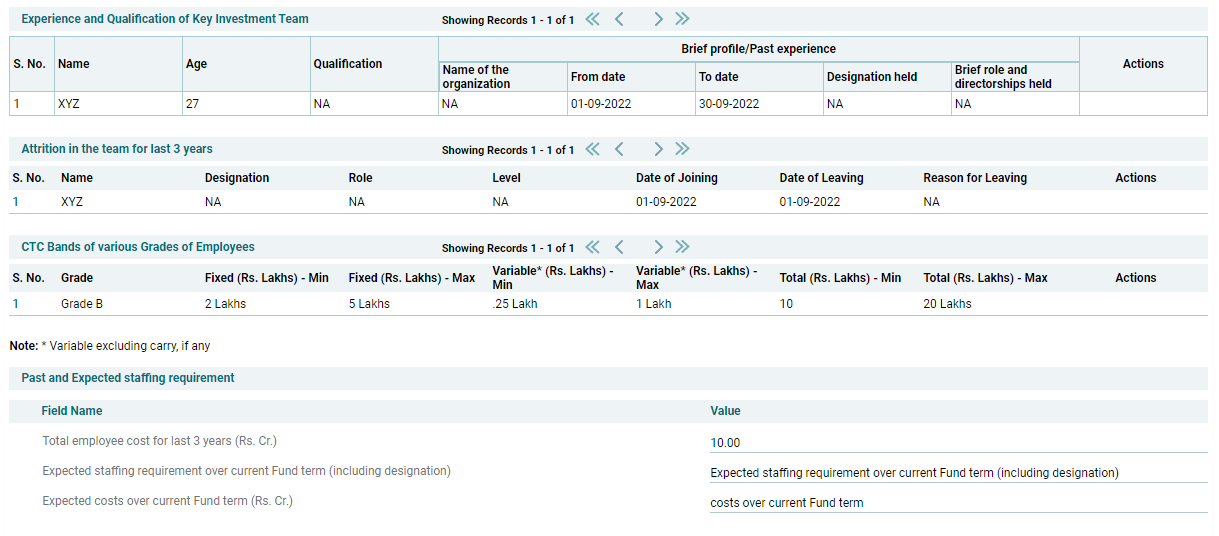

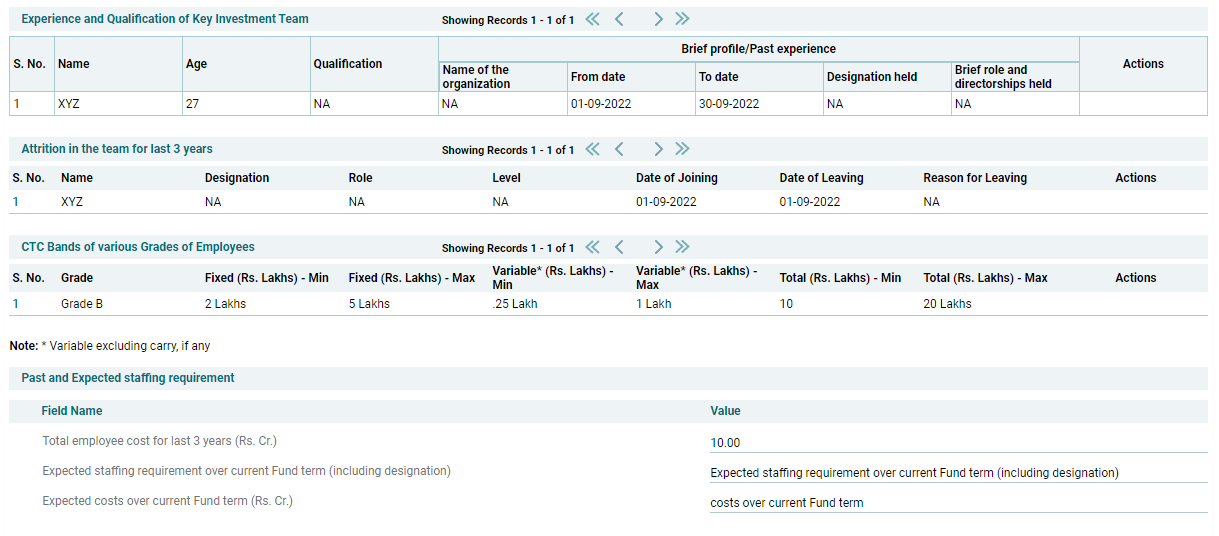

iv. Experience and Qualification

of Key Investment Team

In this sub-panel AIF user needs to enter the total experience and qualification

of the key investment team, to check whether they are fit to handle the

investment.

v. Attrition in the Team for

Last 3 Years

In this sub-panel AIF user needs to mention whether any staff was removed from

the team and why.

vi. CTC Bands of Various Grades

of Employees

In this sub-panel AIF user needs to enter the CTC of different grades f

employees of the investment team and total expenditure on their payroll.

vii. Past and Expected Staffing

Requirement

In this sub-panel AIF user needs to mention the present and past staffing

requirement. The details included are:

- Total employee cost

for 3 years: In this AIF user needs to fill the employee cost over the past 3 years.

- Expected Staffing

requirement over current Fund Term: In this AIF user needs to fill whether additional staff will

be required to manage the current term.

- Expected Costs over

Current Fund Term: In this AIF user needs to fill the total expected costs during the Fund term.

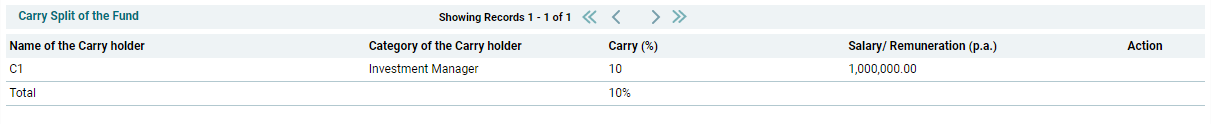

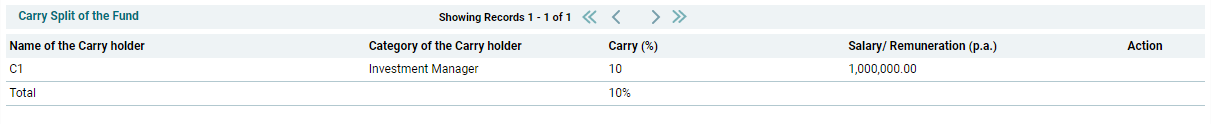

viii. Carry Split of The Fund

In this sub-panel AIF user needs to enter how much carry is held by the carry

holder, if any.

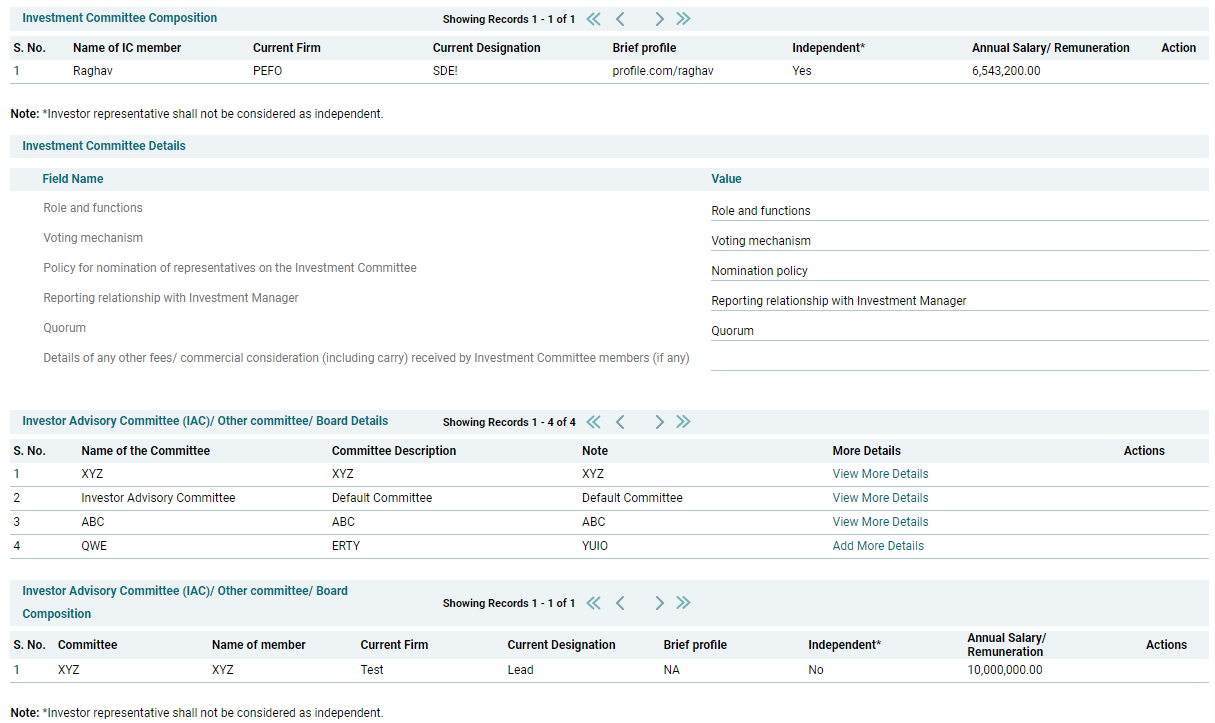

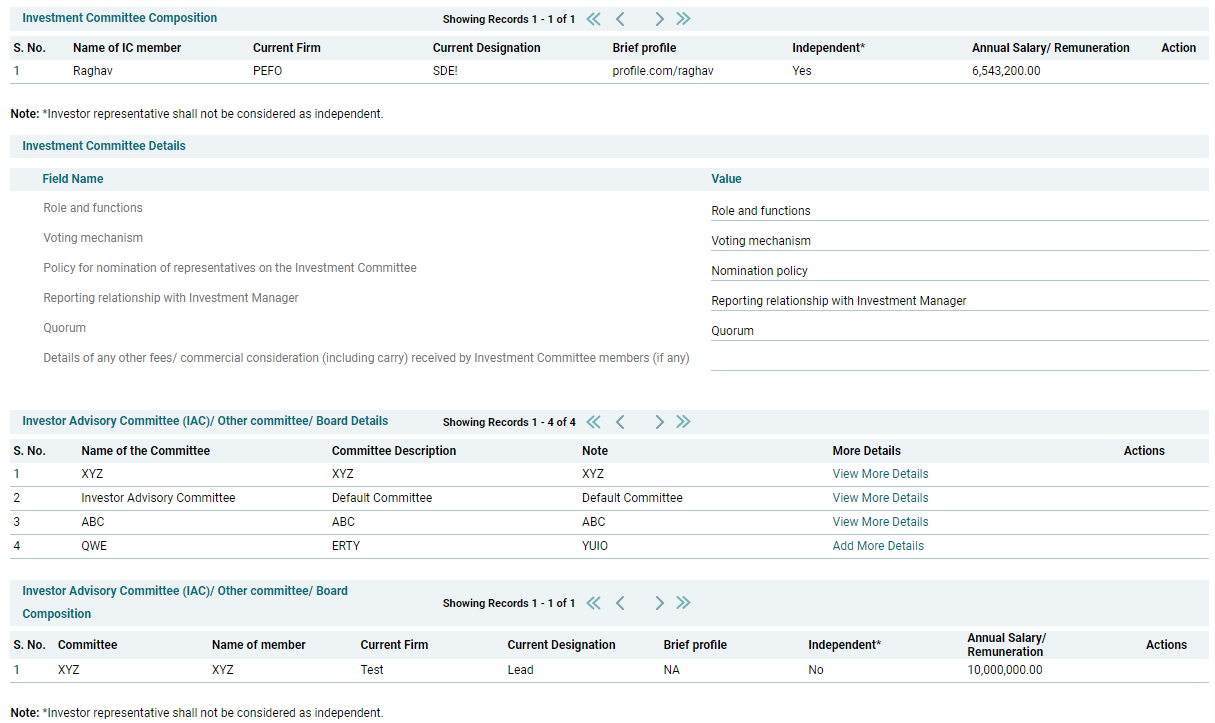

ix. Investment Committee

Composition

In this sub-panel AIF user needs to enter the member details of the investment

committee composition.

x. Investment Committee Details

In this sub-panel AIF user needs to enter the details of Investment committee

including:

- Role and Functions: In this AIF user needs to fill what will be the role and functions of the committee.

- Voting Mechanism: In this AIF user needs to fill what will be the voting mechanism of the committee.

- Policy for

nominations of representations of the Investment committee: In this AIF user needs to fill what

will the nomination policy for committee members.

- Reporting Relationship with Investment

Manager: In this AIF user needs to fill what will be the reporting mechanism.

- Quorum: In this AIF user needs to fill how many members will form a quorum.

- Details of any other

fees/ commercial consideration received by Investment Committee: In this AIF user needs to fill the details of any other fees or consideration that the Investment Committee

has received.

xi. Investor Advisory Committee/

Other Committee/ Board Details

In this sub-panel AIF user needs to enter the member details of the advisory

committee/ other committee/ Board.

xii. Investor Advisory Committee/ Other Committee/

Board Composition

In this sub-panel AIF user needs to enter the composition of the IAC/ other

committee/ Board.

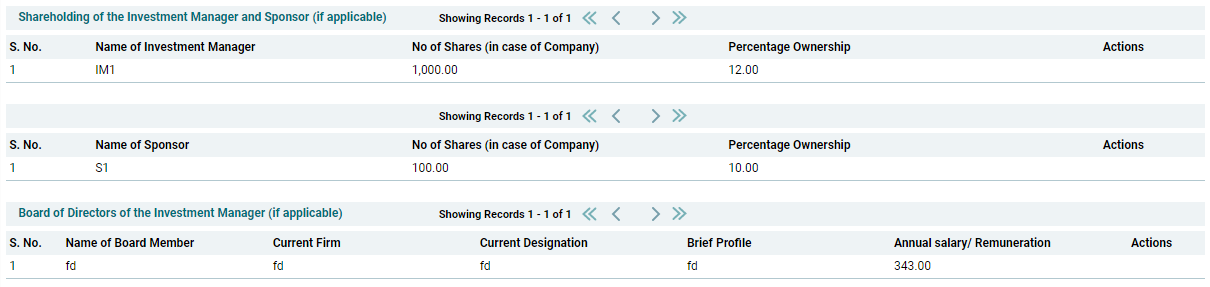

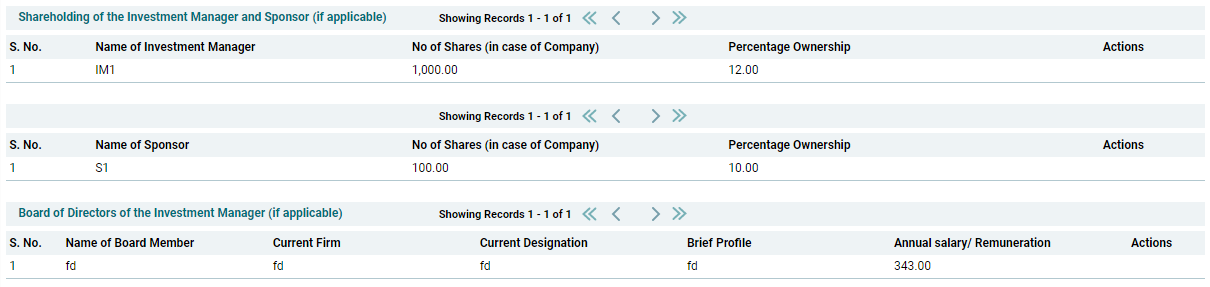

xii. Shareholding of the

Investment Manager and Sponsor (if applicable)

In this sub-panel AIF user needs to enter the shareholding of IM and sponsor,

if any.

xiv. Board of Directors of the

Investment Manager (if applicable)

In this sub-panel AIF user needs to enter the Board of Directors of IM and

sponsor, if any.

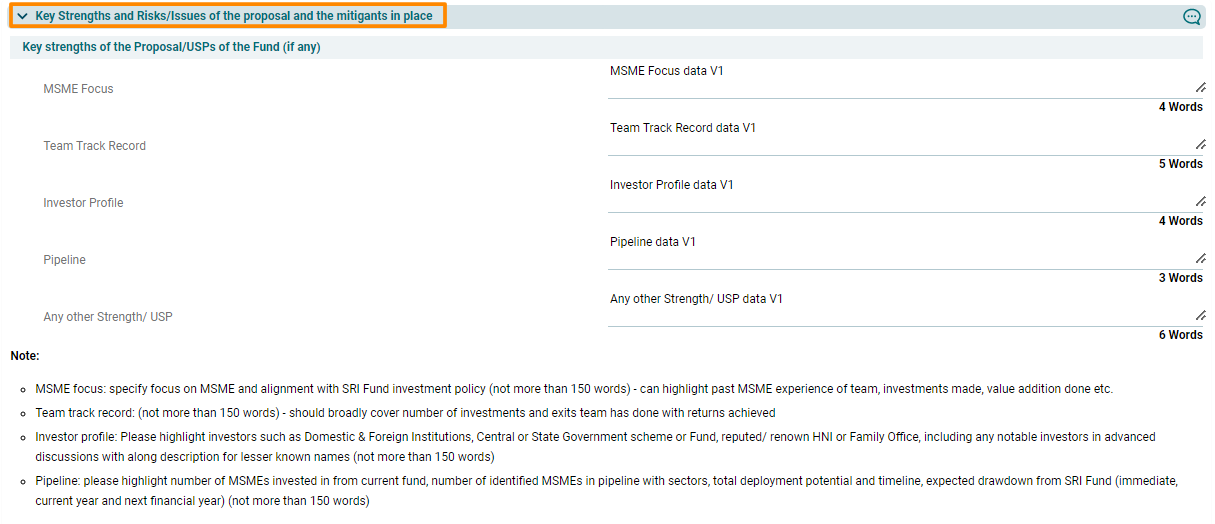

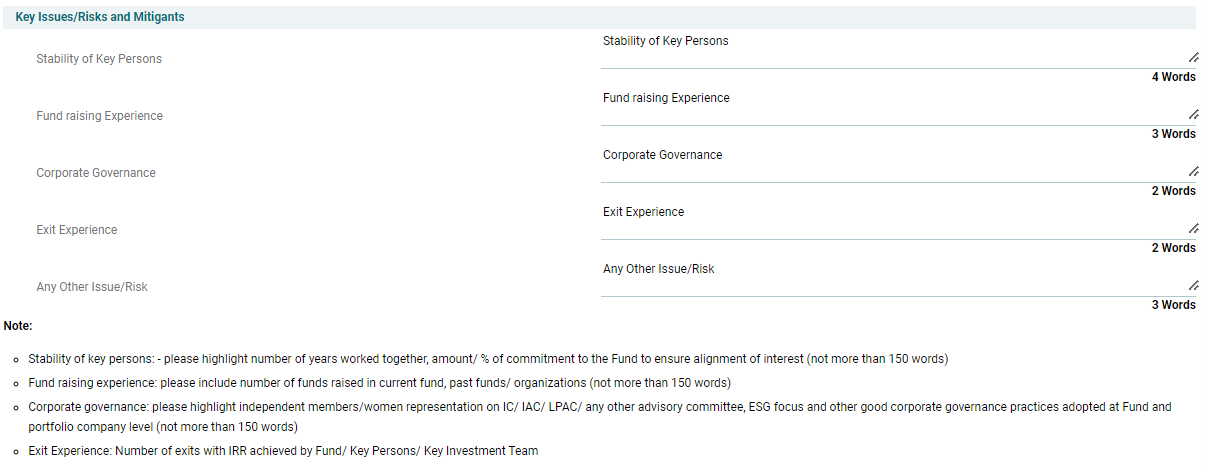

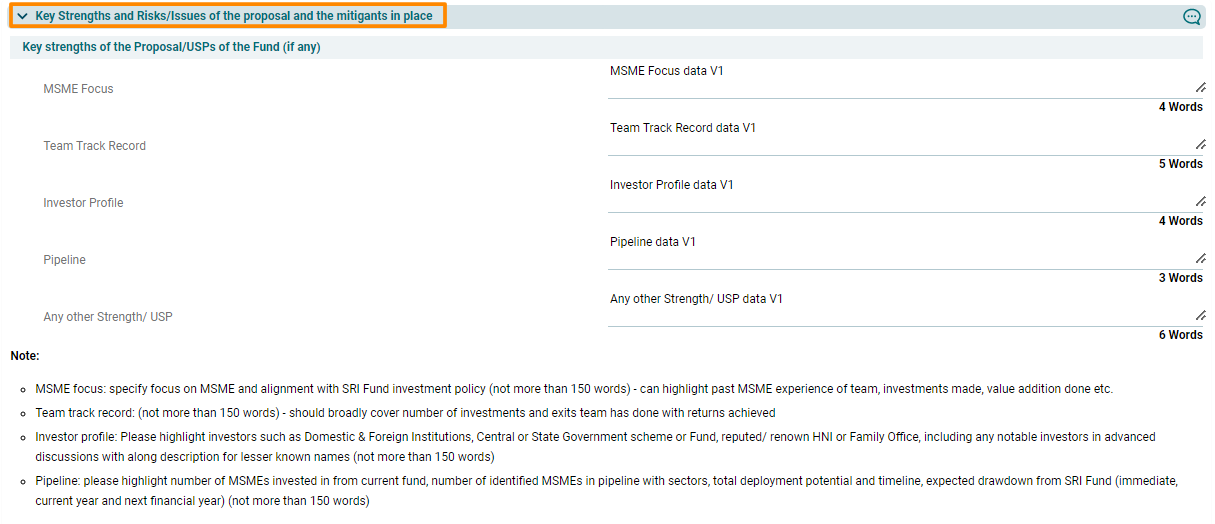

5. Key Strength and Risks/Issues of the Proposal and Mitigation in Place

In this panel AIF user needs to mention the strengths and risks associated

with the proposal.

It has the following sub-panels:

i. Key strengths of the

Proposal/USPs of the Fund (if any)

In this sub-panel AIF user needs to mention the strengths of the proposal, it’s

USPs, focus, etc.

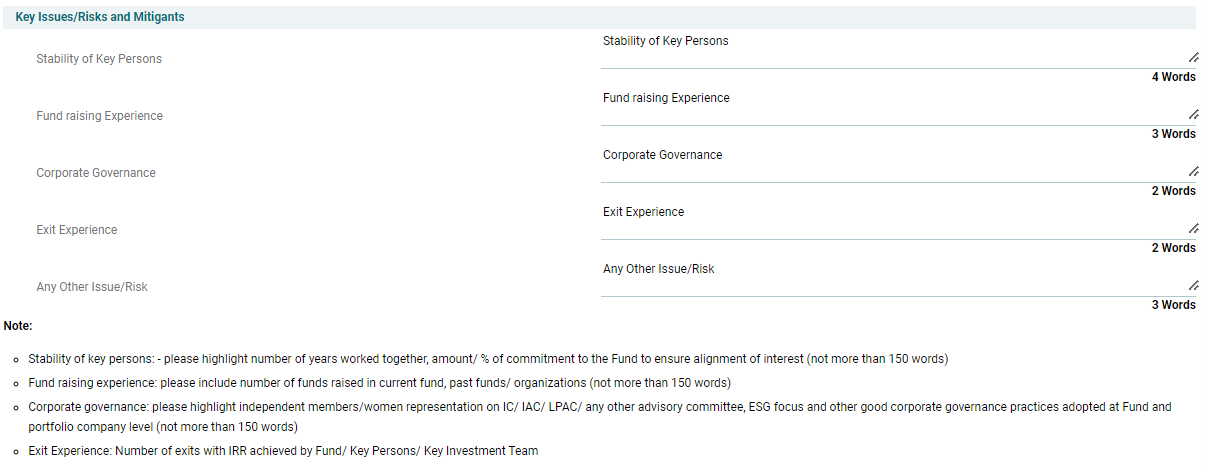

ii. Key Issues/Risks and

Mitigants

In this sub-panel AIF user needs to mention the risks, issues, and mitigants

associated with the proposal.

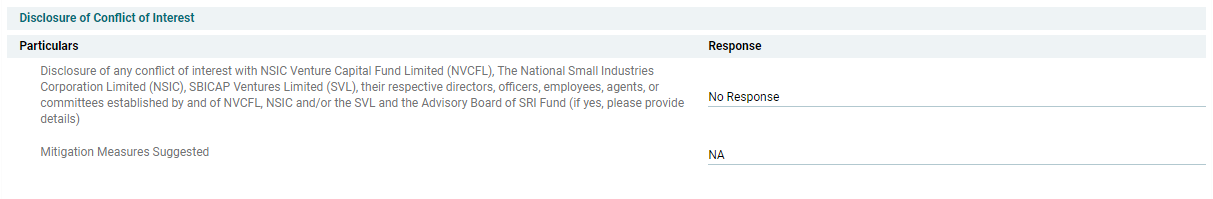

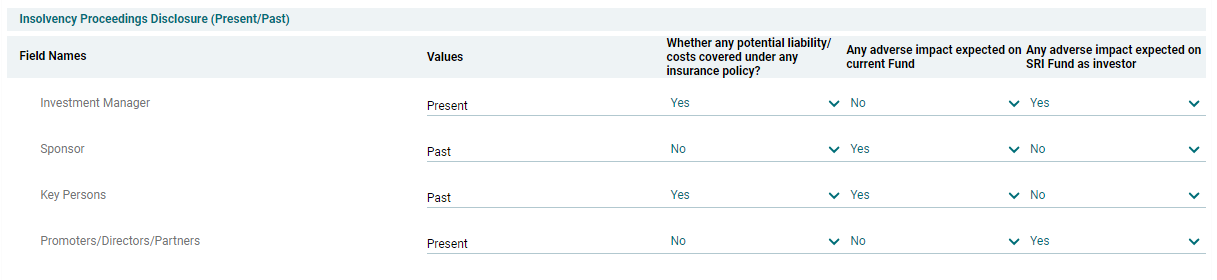

6. Disclosure

In this panel AIF user needs to enter the various disclosures required from

the key persons.

i. Legal and Other Disclosures

In this sub-panel AIF user needs to enter the key disclosures received from

the key persons involved in the investment proposal, including Investment

Manager, Sponsor, Fund, Key persons, Promotors/ Directors/ Partners, Funds, and

Arrears.

The following disclosures are required:

- ·

Whether any potential liability/ costs covered

under any insurance policy?

- ·

Any adverse impact expected on current Fund

- ·

Any adverse impact expected on SRI Fund as

investor

ii. Field Names

In this sub-panel AIF user needs to mention the details of any key persons who

are politically exposed.

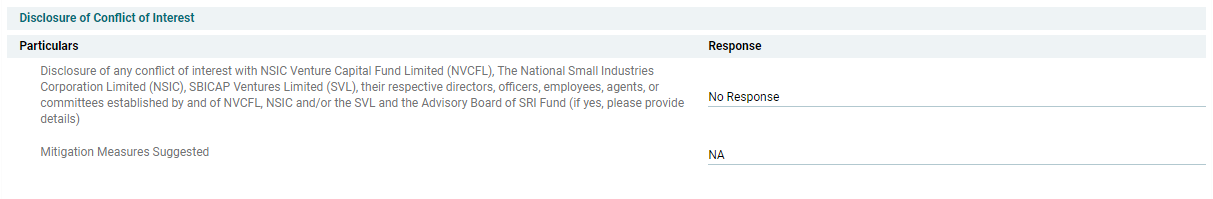

iii. Disclosure of Interest

In this sub-panel AIF user needs to mention the details of any conflict of

interest that any ey person is facing with NSIC Venture Capital Fund Limited

(NVCFL), The National Small Industries Corporation Limited (NSIC), SBICAP

Ventures Limited (SVL), their respective directors, officers, employees,

agents, or committees established by and of NVCFL, NSIC and/or the SVL and the

Advisory Board of SRI Fund (if yes, please provide details).

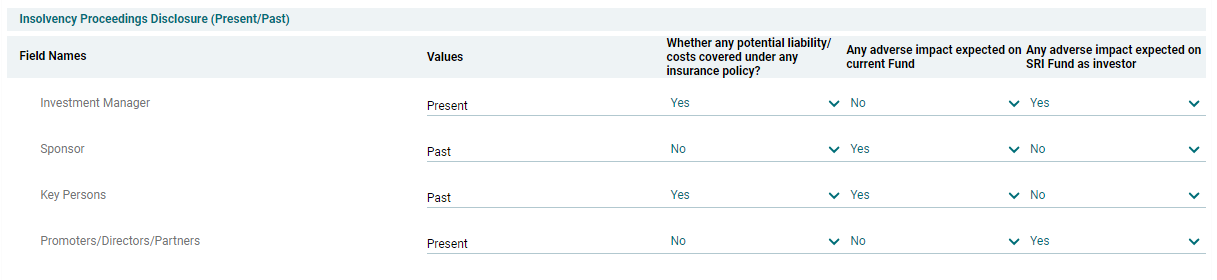

iv. Insolvency Proceedings

Disclosure (Present/ Past)

In this sub-panel AIF user needs to enter the disclosures if Investment

Manager, Sponsor, Promoters/ Directors/ Partners or Key persons are facing or

have faced any insolvency proceedings.

The following disclosures are required:

- ·

Whether any potential liability/ costs covered

under any insurance policy?

- ·

Any adverse impact expected on current Fund

- ·

Any adverse impact expected on SRI Fund as investor

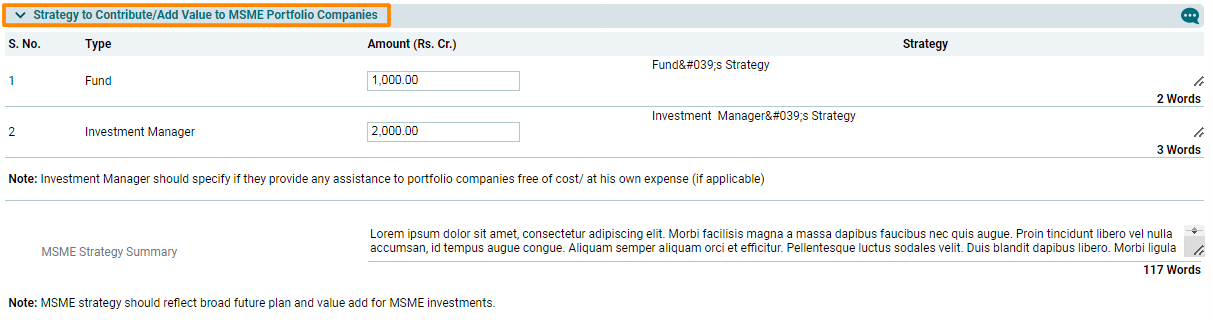

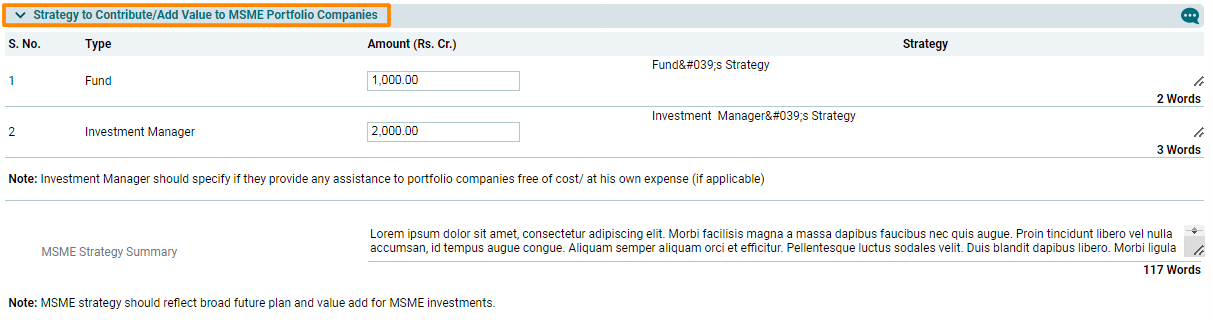

7 7. Strategy to Contribute/Add Value to MSME Portfolio Companies

In this panel AIF user needs to enter the strategy of contribution to other

MSME portfolio companies.

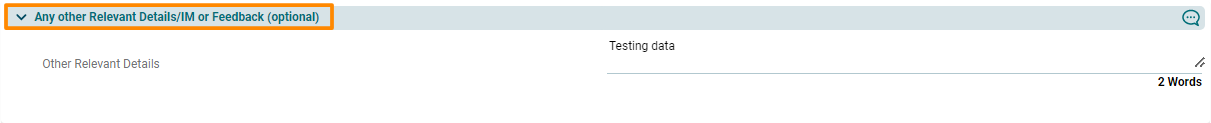

8. Any Other Relevant Details/IM or Feedback (optional)

In this panel AIF user needs to enter the other relevant details, if any.

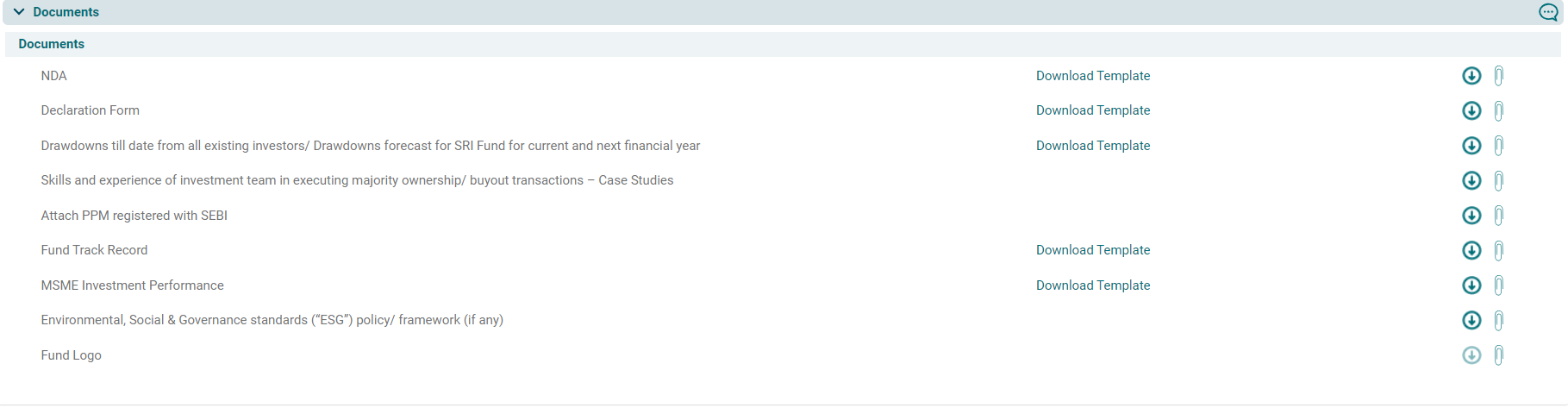

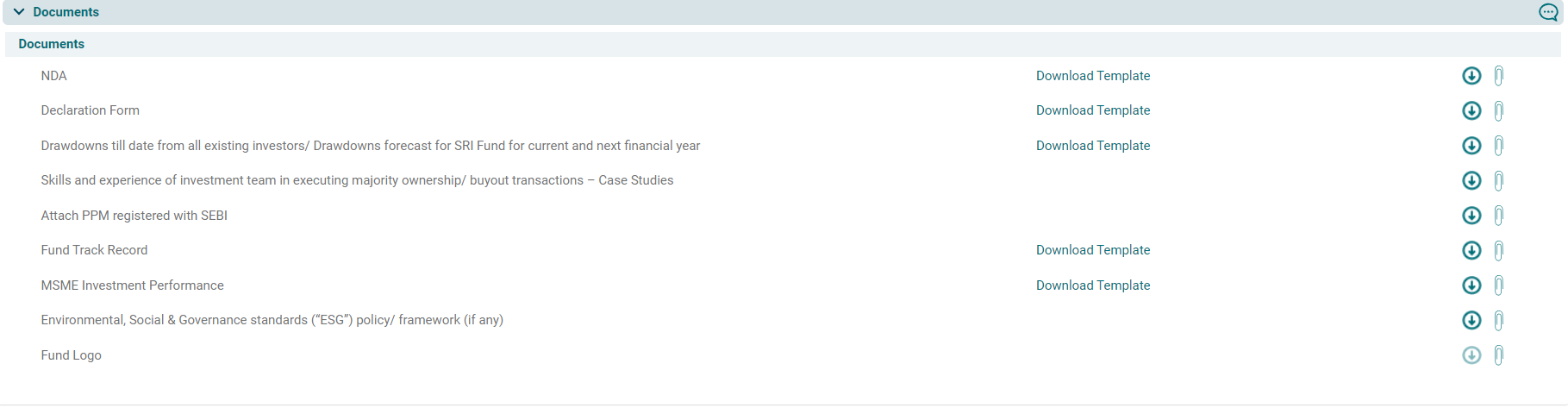

9. Documents

In this panel AIF users can download and attach template for

various documents including NDA, declaration Form, Fund Track record, PPM

registered with SBI, Executed NDA, etc. AIF can also attach fund logo of the daughter fund under this panel

To download a template, click on the Download Template

button. The file will download.

To upload the filled document, click on Attach ( ) button. Choose

the file and click Open.

) button. Choose

the file and click Open.

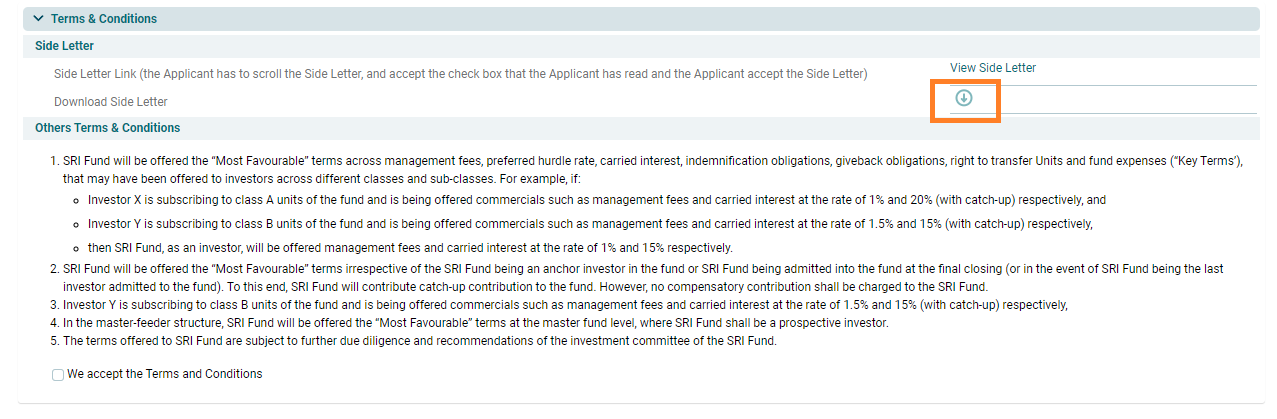

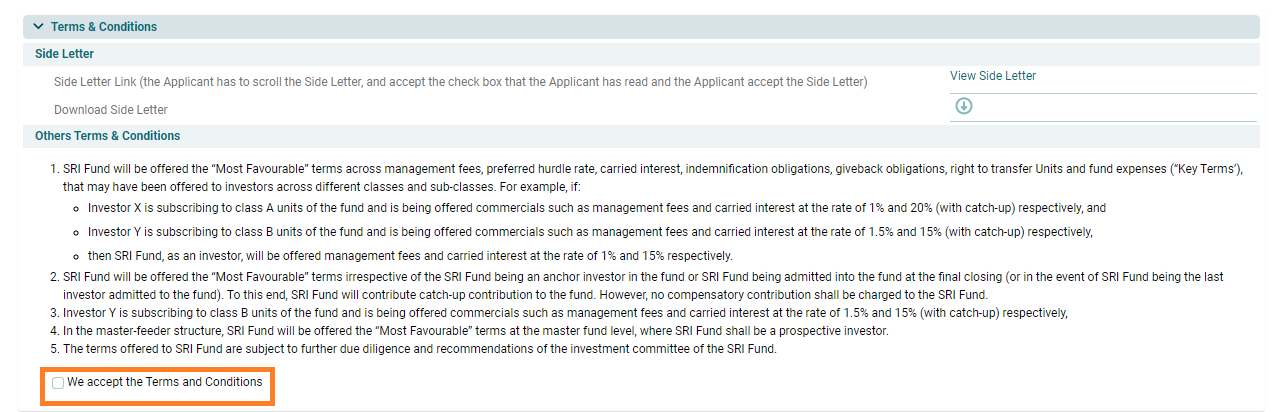

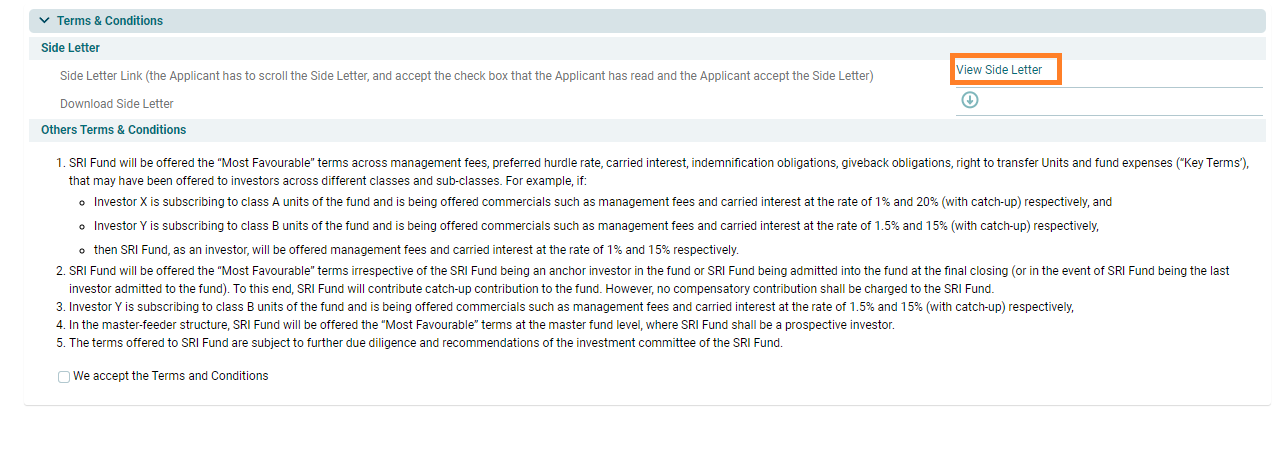

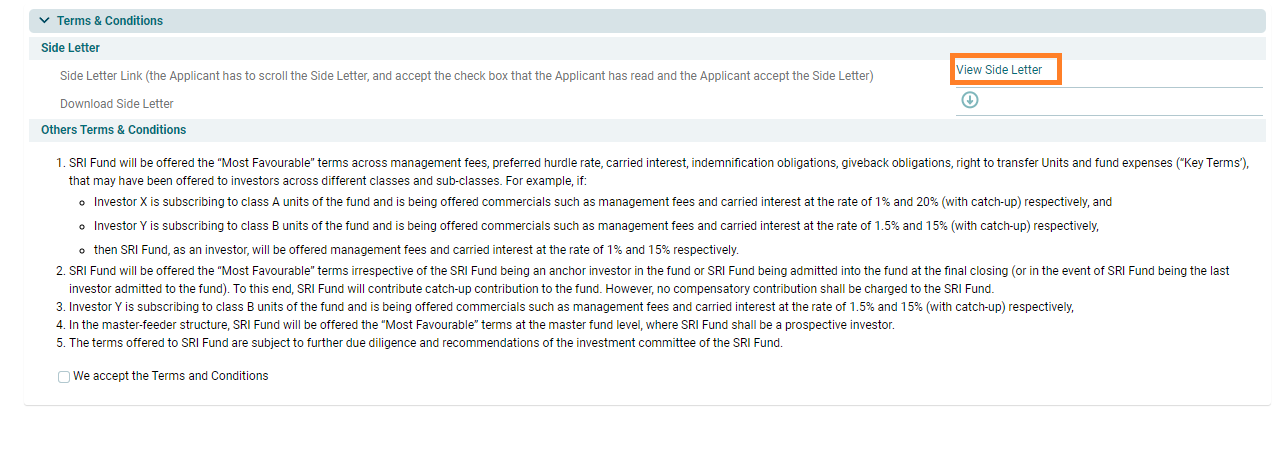

10. Terms & Condition

In this panel AIF user has to view the side letter by clicking on the View Side Letter and ticking the checkbox below of the side letter.

) button. Choose

the file and click Open.

) button. Choose

the file and click Open.

AIF user can also download the side letter by clicking on  icon.

icon.